From our CEO

We want to provide transparency on our corporate sustainability practices and the advancements we have made integrating ESG risk and opportunity assessments across our portfolio.”

- Ken Kencel, President & CEO, Churchill

Churchill 2023 Sustainability Report

Churchill Asset Management is pleased to present its second annual Sustainability Report. Reflecting on the accomplishments of the past year, the report emphasizes the many partnerships built with investors and organizations that have provided invaluable insights to Churchill's investment teams and investor base.

The Churchill footprint

Churchill’s commitment in transitioning to a low carbon economy goes beyond our portfolio investments. In 2022, we began the process to measure our firm-level emissions in order to understand how we can reduce our own operational carbon footprint alongside our portfolio investments.

Cover direct emissions from sources owned and controlled by the company, such as heating units in our office buildings.

ESG integration at Churchill

We believe that the inclusion of ESG principles in our investment and decision-making processes ultimately makes us better investors, both by helping to reduce risk and create value.

Click on each tab to view the details:

Industry initiatives

Churchill’s parent company, Nuveen (the asset manager of TIAA), has been a leader in responsible investing for five decades. Nuveen’s pioneering effort to practice responsible investing dates back to the 1970s and the firm was one of the first institutional investors to engage in dialogue with companies and investors on ESG.

*Nuveen's responsible investing team activities (which is inclusive of TIAA's responsible investing team) began responsible investing initiatives in 1978 while they were under TIAA.

**Clicking these links below will take you to websites independent of and unaffiliated with Nuveen. The information and services provided on this independent site are not reviewed, guaranteed, or endorsed by Nuveen or its affiliates. Please keep in mind that this independent site’s terms and conditions, privacy and security policies, or other legal information may be different from those of Nuveen’s site. Nuveen is not liable for any direct or indirect technical or system issues, consequences, or damages arising from your use of this independent website.

Principles for Responsible Investment

Churchill partnered with the United Nations Principles for Responsible Investment (“PRI”) and other PRI signatories to develop the Private Credit—Private Equity ESG Factor Map to streamline the ESG information shared during the investment process.

Download ESG factor map

ESG Integrated Disclosure Project

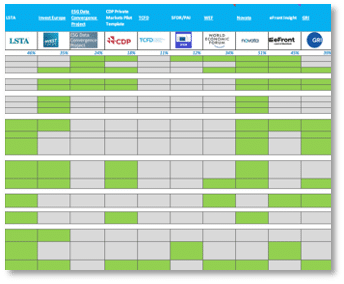

Churchill joined the executive committee for the ESG Integrated Disclosure Project (“ESG IDP”), an industry initiative bringing together leading lenders in private credit to improve ESG data transparency.

Download template

Private Debt Investor

Churchill and Nuveen participated in the 2022 Private Debt Investor ESG Report sharing their approach to ESG in private debt.

Read articleAlignment with the SDGs

We assess all investments for alignment with one or more of the sustainable development themes covered by the UN Sustainable Development Goals (SDGs) using a proprietary SDG framework.

Source: United Nations SDGs

Important information on risk

Responsible investing incorporates Environmental Social Governance (ESG) factors that may affect exposure to issuers, sectors, industries, limiting the type and number of investment opportunities available, which could result in excluding investments that perform well.

ESG integration is the consideration of financially material ESG factors within the investment decision making process. Financial materiality and applicability of ESG factors varies by asset class and investment strategy. ESG factors may be among many factors considered in evaluating an investment decision, and unless otherwise stated in the relevant offering memorandum or prospectus, do not alter the investment guidelines, strategy, or objectives. Select investment strategies do not integrate such ESG factors in the investment decision making process.

No strategy can eliminate or anticipate all market risks, and losses can occur.

G-3712315C-Y0724W