In The News

Bloomberg Surveillance: Renewed confidence in private equity and optimism in deal flow

New York, June 26, 2025 – Randy Schwimmer, Vice Chairman and co-head of Senior Lending at Churchill Asset Management, discusses renewed confidence in private equity and whether there’s rising risks in private credit…

Ken Kencel on private credit opportunities

Los Angeles, May 6, 2025 – Live from the 2025 Milken Institute Global Conference, CEO Ken Kencel addressed areas of opportunity opening within private credit, as companies seek alternatives to the syndicated loan market.

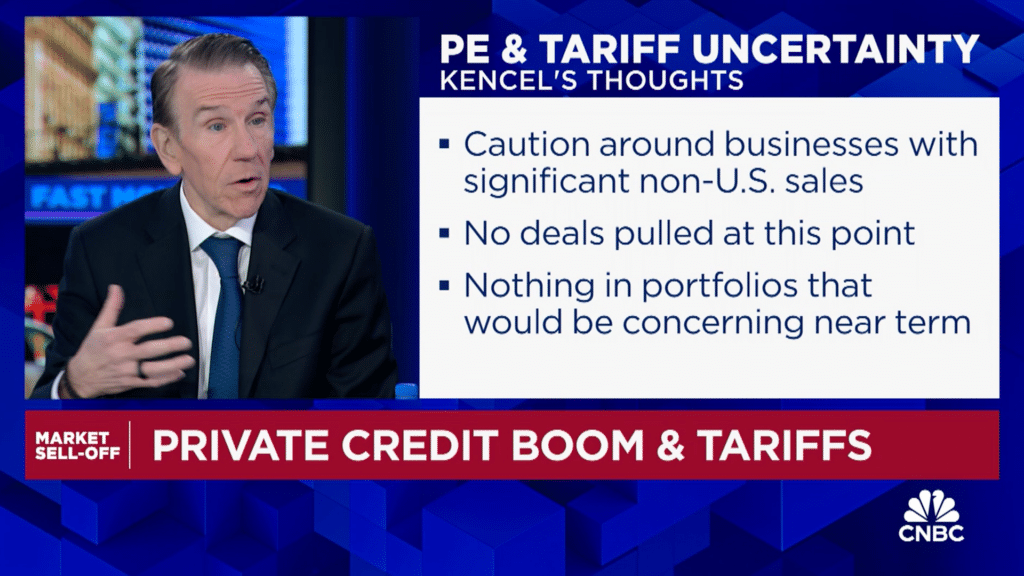

Ken Kencel on CNBC discussing the impact of tariffs on private credit

April 8, 2025 – Ken Kencel, Churchill Asset Management president and CEO, joins the ‘Fast Money’ traders to discuss the state of the private credit market and why he’s maintaining an optimistic outlook.

Bloomberg Surveillance: Randy Schwimmer shares key takeaways from 2024 market performance

January 7, 2025 – Vice Chairman of Investor Solutions Group, Randy Schwimmer appeared on Bloomberg Surveillance to discuss inflation coming under control with interest rates, market activity and stronger tailwinds for M&A activity ahead.

CNBC: Private credit boom is rooted in strong fundamentals, says Churchill’s Alona Gornick

New York, December 27th, 2024 – Churchill Managing Director and Senior Investment Strategist Alona Gornick appeared on CNBC’s “Fast Money” to discuss the current state of the private credit industry and the strong fundamentals driving its growth.

Alona Gornick on the the Wall Street Skinny

New York, December 3, 2024 – Churchill’s Alona Gornick joins the discussion about the critical considerations private equity firms must weigh when choosing between traditional financing methods and direct lending, including efficiency, certainty of execution, and incremental financing.

Alona Gornick on the evolution of private credit

New York, November 14, 2024 – Churchill’s Alona Gornick joins Michael Sidgmore on the Alt Goes Mainstream podcast to delve into the evoving landscape of private credit, the power of permanent capital, and the essential role of the product specialist.

Churchill Sees Mid-Market Loan Value ‘in Plain Sight’

New York, October 31, 2024 – Schwimmer and Holland discuss loan margin and covenant trends, fundraising, private credit innovation, the impact of higher-for-longer rates and regulation.

Bloomberg Surveillance: Randy Schwimmer on private credit & capital markets trends in an evolving interest rate environment

New York, October 30, 2024 -Randy Schwimmer, Vice Chairman of Investor Solutions Group at Churchill Asset Management, on the velocity in private credit and why it’s “adapt or die” time for credit managers.

Churchill’s Kencel on Private Credit Market, Partnerships

New York, October 3, 2024 – Churchill Asset Management President and CEO Ken Kencel discusses the state of private credit markets.

Alona on Bloomberg Businessweek

New York, September 17, 2024 – Alona Gornick, Senior Investment Strategist at Churchill Asset Management, shares her thoughts on private credit.

Alona Gornick on Yahoo! Finance discussing Private Credit 101

New York, July 31, 2024 – Churchill Asset Management senior investment strategist Alona Gornick joins Wealth! to break down how private credit works and how investors can best utilize it for their portfolios.

CNBC: M&A is already increasing ‘modestly’ and expected to pick up in second half, says Churchill’s Kencel

New York, July 29th, 2024 – Churchill President & CEO Ken Kencel joined CNBC TV’s ‘Money Movers’ to discuss the current state of dealmaking and expectations for the second half of 2024.

Private Capital with Joe Reilly

New York, July 7th, 2024 – Ken Kencel is the President & CEO of Churchill Asset Management, a $50 billion dollar platform serving over 700 institutional clients. He shared valuable insights on the growing private credit market, the evolution of the industry, his first job at Drexel, working at Carlyle and then going out on his own to start Churchill from scratch. We also discuss the nuances of the art of the covenent and finish with Ken’s desert island discs.

Behind the Buyouts: Churchill’s Philpott on Private Credit Boom

New York, April 23rd, 2024 – Churchill managing director Anne Philpott discusses the firm’s direct lending and PE strategies and expectations for M&A in 2024.

Churchill’s CEO Ken Kencel: It’s a good time to be a direct lender

New York, December 27, 2023 – Churchill Asset Management CEO Ken Kencel joins CNBC’s ‘Squawk Box’ to discuss his market expectations in 2024, what investors need to know, and more.

Churchill’s Schwimmer: Investor demand drives private credit boom

New York, November 28, 2023 – Randy Schwimmer, co-head of senior lending at Churchill Asset Management, joins Bloomberg Radio to discuss the private credit boom.

Churchill’s Kencel Says Private Credit in ‘Golden Age’

Greenwich, October 3, 2023 – Churchill Asset Management President and CEO Ken Kencel discusses the impact of higher interest rates on private credit deals on “Bloomberg Markets: The Close.”

Ken Kencel on iCapital’s Beyond 60/40

New York, June 26, 2023 – iCapital Chief Investment Strategist Anastasia Amoroso discusses the private credit markets with Churchill Asset Management President and CEO Ken Kencel…

Ken Kencel on Best of Times for Private Credit

New York, June 23, 2023 – Churchill’s President & CEO Ken Kencel joined Carol Massar and Matt Miller on Bloomberg Businessweek for an in-depth discussion about the private credit landscape and drivers behind the industry’s exponential growth over the last decade…

Randy Schwimmer on What Cracks the Debt Ceiling Deadlock

New York, May 9, 2023 – Randy Schwimmer, Co-Head of Senior Lending at Churchill Asset Management, joined the Bloomberg Markets Americas segment hosted by Alix Steel and Guy Johnson to discuss the potential implications of factors such as the potential end of rate hikes, bank failures, and recession fears on the private credit outlook…

Randy Schwimmer on Private Credit, Lending, and the Credit Crunch

New York, May 9, 2023 – Randy Schwimmer, Co-head of Senior Lending at Churchill Asset Management, discusses private credit, lending, and the credit crunch with Paul Sweeney and Kriti Gupta on Bloomberg’s The Tape…

Ken Kencel on Private Credit, Investing Focus, Banks

New York, May 2, 2023 – Churchill Asset Management’s President & CEO Ken Kencel discusses the banking crisis and the increasingly important role of private capital in middle market dealmaking with Bloomberg’s Romaine Bostick from the sidelines of the 2023 Milken Global Conference in Beverly Hills, California…

Randy Schwimmer on Diversify Beyond Traditional Asset Classes with Private Credit

New York, April 21, 2023 – Randy Schwimmer, Co-Head of Senior Lending from Churchill Asset Management, joins APB to discuss the use of private credit in portfolio diversification, trends in investor appetite, and where future demand will emerge from…

Randy Schwimmer on the Private Debt landscape in Asia-Pacific

New York, April 5, 2023 – Randy Schwimmer, Co-Head of Senior Lending at Churchill Asset Management, on private debt markets. He spoke with hosts Doug Krizner and Paul Allen on “Bloomberg Daybreak Asia.”…

Ken Kencel on the Rise of Private Capital

New York, March 31, 2023 – Churchill’s President & CEO Ken Kencel joined Bloomberg’s Masters in Business podcast to discuss the pivotal moments in his personal life and career that led him where he is today, his firsthand experience in the evolution of private capital as well as the future of the industry…

Randy Schwimmer on The Hot Start to 2023 for Private Credit

New York, March 5, 2023 – Randy Schwimmer, Co-head of Senior Lending at Churchill Asset Management, discusses the economic outlook, the M&A environment, and the private debt opportunity today…

The Top Quartile: In Conversation with Chris Freeze

New York, March 4, 2023 – In this edition of The Top Quartile: In Conversation, Andrés Ramos, content specialist at Nasdaq Private Fund Solutions, sits down with Chris Freeze, Senior Managing Director and Head of Investor Relations at Churchill Asset Management…

News

Churchill Asset Management Hires New Managing Director

NEW YORK, October 14, 2016 – Churchill Asset Management announced that Leland Richards has joined the firm as a managing director. The appointment will be effective October 2016 and Richards will report to Senior Managing Director and Head of Origination and Capital Markets Randy Schwimmer.

US Roundtable 2016

NEW YORK, September, 2016 – As the private mid-market debt asset class grows, choosing the right lending partnerships and financing diversification are uppermost in the minds of some of the market’s leading operators. Andrew Hedlund sat down with seven US private debt experts to find out more.

Churchill Closes $382.2 Million CLO, First Under Ferguson’s TIAA

NEW YORK, September 15, 2016 – Churchill Asset Management closed a $382.2 million collateralized loan obligation, the first since it was established by TIAA last year. The CLO is comprised of middle-market loans and attracted capital from a range of institutional investors, Churchill said Thursday in a statement.

Upcoming Events

Please click to view agenda

Press Releases

Nuveen Private Capital Named 2025 “Institutional Direct Lender Firm of the Year” in the 16th Annual International M&A Awards

New York, NY, June 26, 2025 – Nuveen Private Capital, which is comprised of U.S. and European asset managers Churchill Asset Management and Arcmont Asset Management, today announced it has been named 2025 “Institutional Direct Lender Firm of the Year” in the 16th Annual International M&A Awards. The team will be honored at a black-tie gala on Tuesday, September 16th in New York City.

Middle Market Private Equity Firms Cautiously Optimistic on M&A, Exits and Returns, Churchill Asset Management Survey Finds

New York, NY, June 24, 2025 – The survey polled 164 senior leaders from Churchill’s private equity relationships to gauge sentiment in today’s market environment and how these perspectives are influencing investment decisions.

Churchill Asset Management Raises $1.5 Billion for Co-Investment Fund II

New York, NY, June 10, 2025 – Churchill Asset Management LLC, an investment-specialist of Nuveen, today announced the final close of Churchill Co-Investment Fund II (the “Fund”) with $1.5 billion in limited partner commitments.