White paper

The year ahead: top 5 private capital trends

Private capital stands primed to capitalize on what looks set to be a favorable environment for generating returns and income as the macroeconomic fog clears,…

Private capital call

EP7: Anastasia Amoroso on how investors navigate dynamic markets

This month, we are joined by Anastasia Amoroso, Managing Director and Chief Investment Strategist at iCapital. Anastasia provides expert insights into private and public market…

Publication

PE Hub – ‘Investors will flock to junior capital to lock in long-term, fixed rate return stability’

Junior capital offers delayed draw capacity, which is a critical source of funding for sponsors with buy-and-build investment strategies seeking to make post-closing…

Publication

PE Wire – Outlook 2025: The sustained rise of continuation vehicles

Last year was estimated to deliver $140bn+ in global secondaries volume, the largest year on record and definitively surpassing the prior high threshold of ~$130bn…

Survey

Q4 2024 Pulse on Private Debt Survey

In September 2024, Churchill conducted a survey of 74 investors, comprising 82% institutional investors and 18% private wealth investors. Our goal was to gain deeper…

Video/Podcast

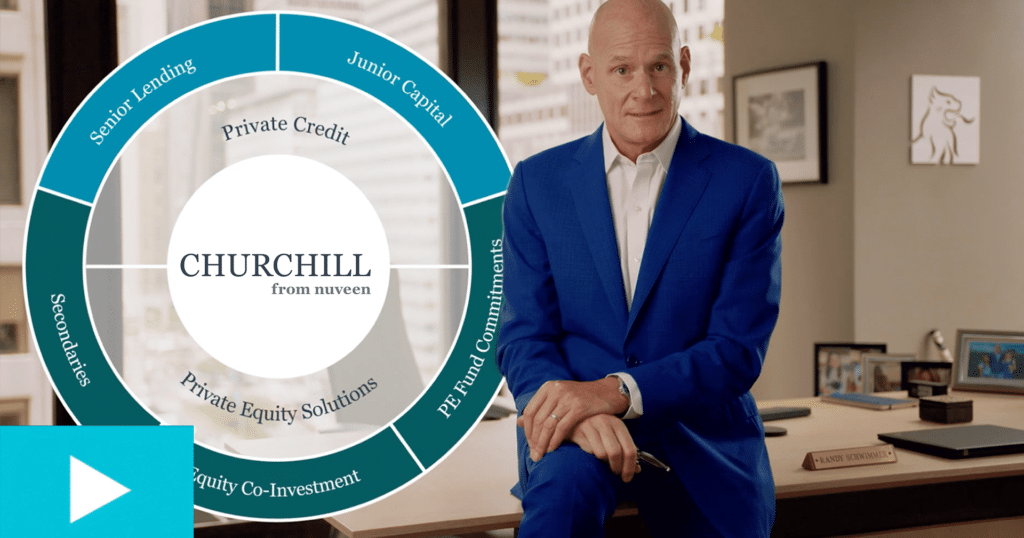

Churchill’s Capabilities

Churchill has a long history of disciplined investing across multiple economic cycles and our unique origination strategy and investment approach are driven by nearly 200…

Publication

PEI – How to be the perfect partner

Co-investing has become the darling of private equity, offering a tantalising combination of financial and strategic advantages over traditional fund deployment. Having a diversified portfolio…

Publication

PDI – Direct lending: Where LPs should be focused

The private debt opportunity in the traditional middle market is often overlooked. While companies in this market may not all be household names, they tend…

Publication

PEI – Secondaries: A growing opportunity

In a recent Q&A interview with Private Equity International, Churchill Asset Management’s Nick Lawler discusses why the Secondaries asset class is one of the most…

Receive latest private capital insights

The Lead Left

With over 40,000 subscribers, our industry-leading weekly newsletter is the premier source of market and trend information for private capital.

Private Capital Call

Thought-provoking conversations with top-decision makers in private capital, asset management & institutional investing.