“We typically invest as a significant limited partner and often serve as an advisory board member.”

Investment Criteria

Company Size (EBITDA)

Average Fund Commitment

Average Equity Co-investment

$10 mm - $100 mm

$30 mm - $75 mm

$10 mm - $100 mm

Disciplined Investment Focus:

We take a differentiated approach to sponsor relationships, specifically targeting those that seek value added partners and support for portfolio company financing needs. We employ a deliberate process to evaluate and underwrite fund investments, typically spanning three to eight weeks.

-

Initial vetting & structuring

-

Early assessment

-

Full due diligence

Recent Equity Solution Transactions

News & Press

Churchill Raises $1.5 Billion for Second Co-Investment Fund

New York, June 10, 2025 – Churchill Asset Management has wrapped up its second equity co-investment fund at almost three-and-a-half times the size of its predecessor, according to the private-credit specialist…

Churchill Asset Management Raises $1.5 Billion for Co-Investment Fund II

New York, NY, June 10, 2025 – Churchill Asset Management LLC, an investment-specialist of Nuveen, today announced the final close of Churchill Co-Investment Fund II (the “Fund”) with $1.5 billion in limited partner commitments.

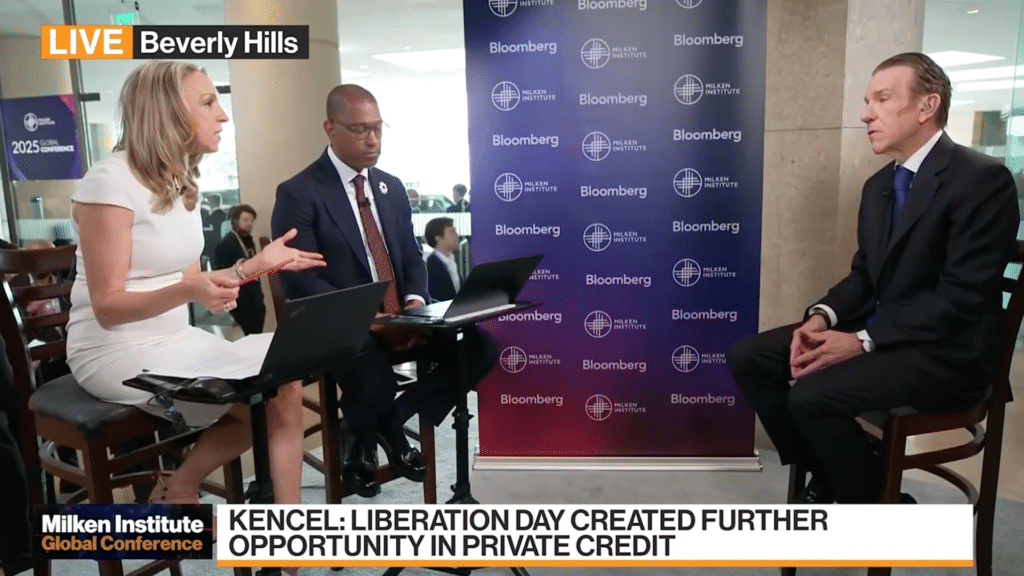

Ken Kencel on private credit opportunities

Los Angeles, May 6, 2025 – Live from the 2025 Milken Institute Global Conference, CEO Ken Kencel addressed areas of opportunity opening within private credit, as companies seek alternatives to the syndicated loan market.