Investment Criteria

Company Size (EBITDA)

Maximum Commitment

Target Investment

$10 mm - $100 mm

Up to $500 mm

$75 mm - $300 mm

Streamlined Investment Process:

We foster a rigorous underwriting of credit. Our deep middle market sponsor relationships enhance our due diligence process.

-

Transaction screening

-

Deep due diligence

-

Investment Committee approval

Recent Senior Transactions

-

Nellson Nutraceutical

Nellson Nutraceutical

Lead Left Arranger

- Senior Secured Credit Facility

Kohlberg & Company

April 2025

-

-

-

News & Press

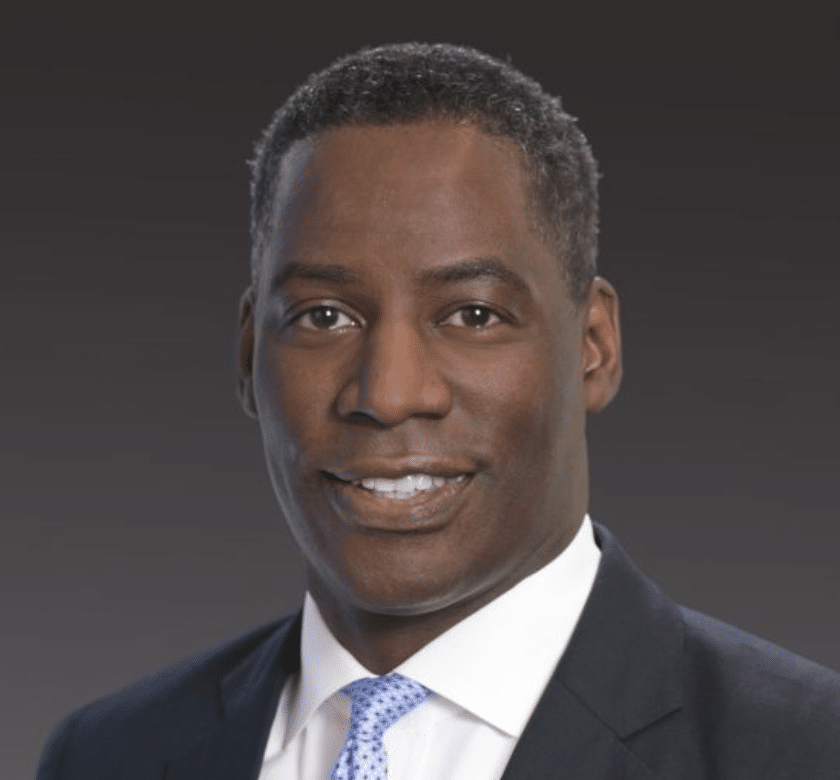

Churchill Asset Management Appoints Leland Richards as Managing Director

New York, October 14, 2016 – Churchill Asset Management LLC (“Churchill”), a majority-owned affiliate of TIAA Global Asset Management focused on originating, underwriting and managing middle market senior loan investments, announced today that Leland Richards has joined the firm as a Managing Director.

US Roundtable 2016

NEW YORK, September, 2016 – As the private mid-market debt asset class grows, choosing the right lending partnerships and financing diversification are uppermost in the minds of some of the market’s leading operators. Andrew Hedlund sat down with seven US private debt experts to find out more.

Churchill Closes $382.2 Million CLO, First Under Ferguson’s TIAA

NEW YORK, September 15, 2016 – Churchill Asset Management closed a $382.2 million collateralized loan obligation, the first since it was established by TIAA last year. The CLO is comprised of middle-market loans and attracted capital from a range of institutional investors, Churchill said Thursday in a statement.