Investment Criteria

Company Size (EBITDA)

Maximum Commitment

Target Investment

$10 mm - $100 mm

Up to $500 mm

$75 mm - $300 mm

Streamlined Investment Process:

We foster a rigorous underwriting of credit. Our deep middle market sponsor relationships enhance our due diligence process.

-

Transaction screening

-

Deep due diligence

-

Investment Committee approval

Recent Senior Transactions

-

Nellson Nutraceutical

Nellson Nutraceutical

Lead Left Arranger

- Senior Secured Credit Facility

Kohlberg & Company

April 2025

-

-

-

News & Press

Middle Market Private Equity Firms Cautiously Optimistic on M&A, Exits and Returns, Churchill Asset Management Survey Finds

New York, NY, June 24, 2025 – The survey polled 164 senior leaders from Churchill’s private equity relationships to gauge sentiment in today’s market environment and how these perspectives are influencing investment decisions.

Ken Kencel on private credit opportunities

Los Angeles, May 6, 2025 – Live from the 2025 Milken Institute Global Conference, CEO Ken Kencel addressed areas of opportunity opening within private credit, as companies seek alternatives to the syndicated loan market.

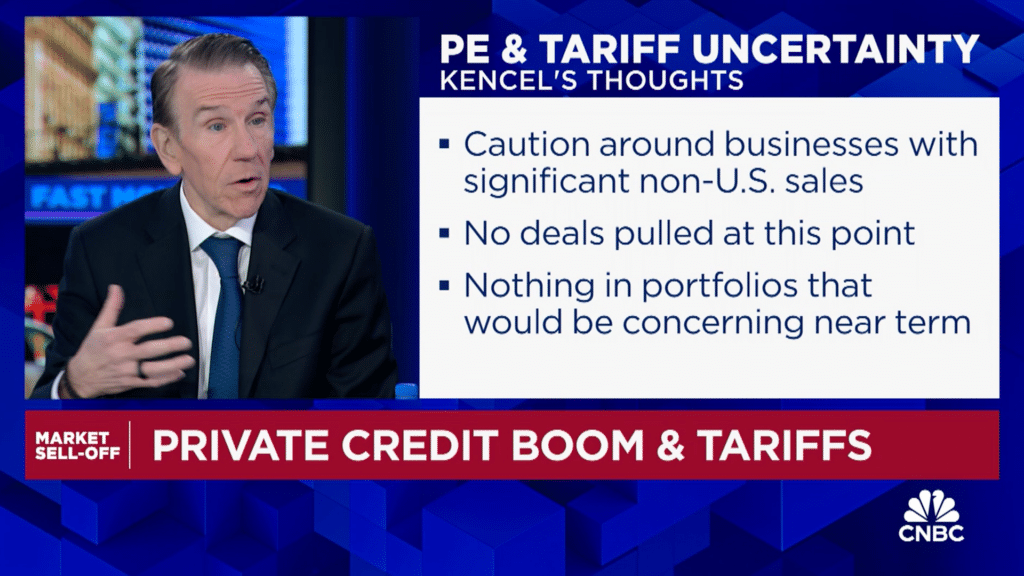

Ken Kencel on CNBC discussing the impact of tariffs on private credit

April 8, 2025 – Ken Kencel, Churchill Asset Management president and CEO, joins the ‘Fast Money’ traders to discuss the state of the private credit market and why he’s maintaining an optimistic outlook.